WHAT IS DEBT TO EQUITY RATIO?

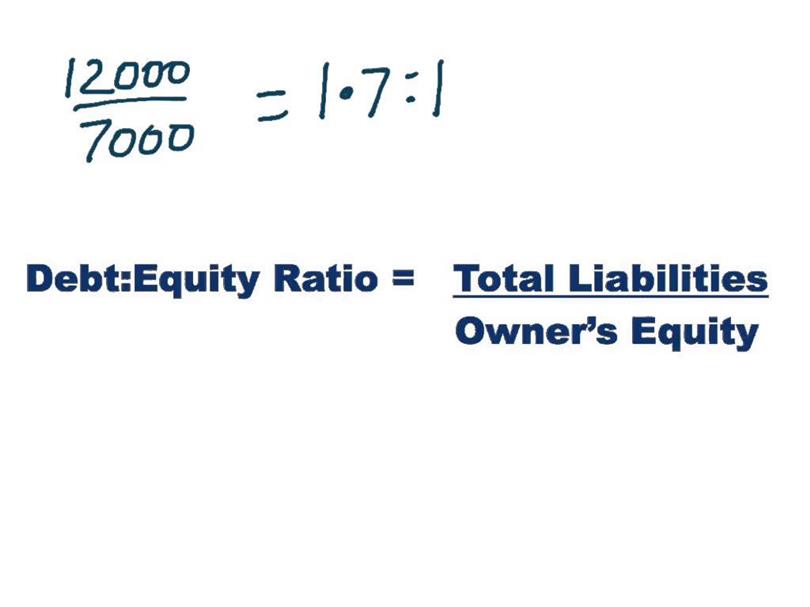

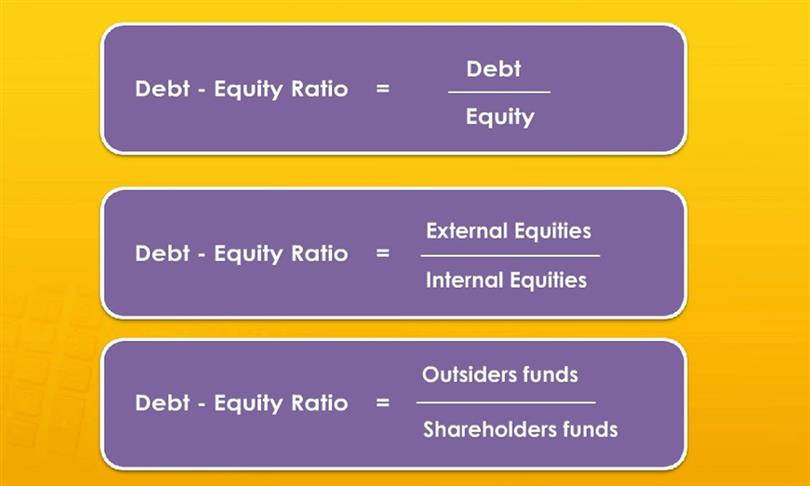

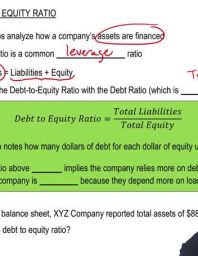

It is a financial ratio obtained by dividing both long and short-term debts (sum of current and non-current liabilities) by the net worth of a company.

Indicates the external financing (proportion of debt) that the company has.

From this ratio we obtain, on the one hand, the ratio of short-term indebtedness (measured by short-term debt or current liabilities, divided by net worth) and by long-term debt (by dividing long-term debt or non-current liabilities).

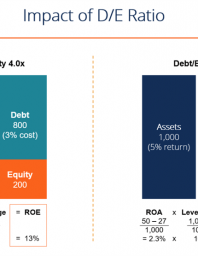

The values gotten from it help analysts to identify additional profitability growth potential, assess the degree of possible risks and determine the dependence of the level of profit on external and internal factors. With the help of this ratio, it is possible to influence the net profit of the organization, managing financial liabilities, and a clear idea of the appropriateness of using credit funds.

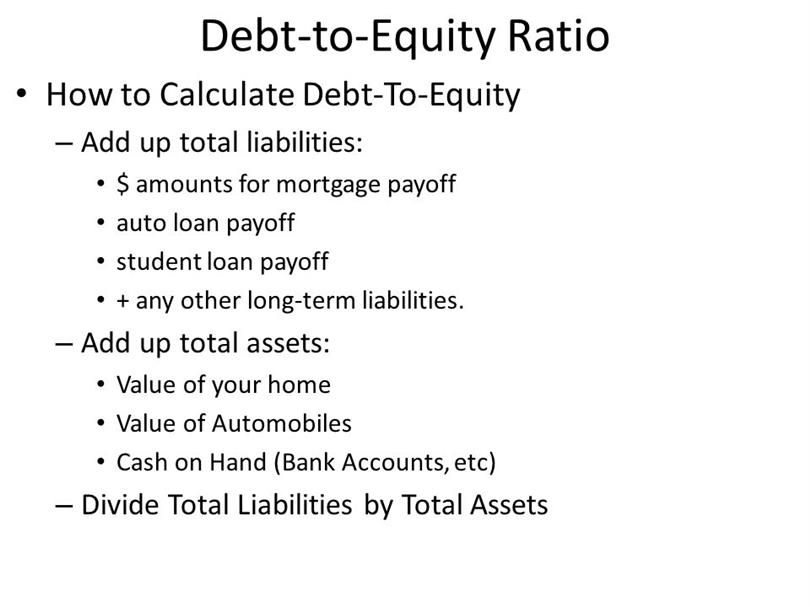

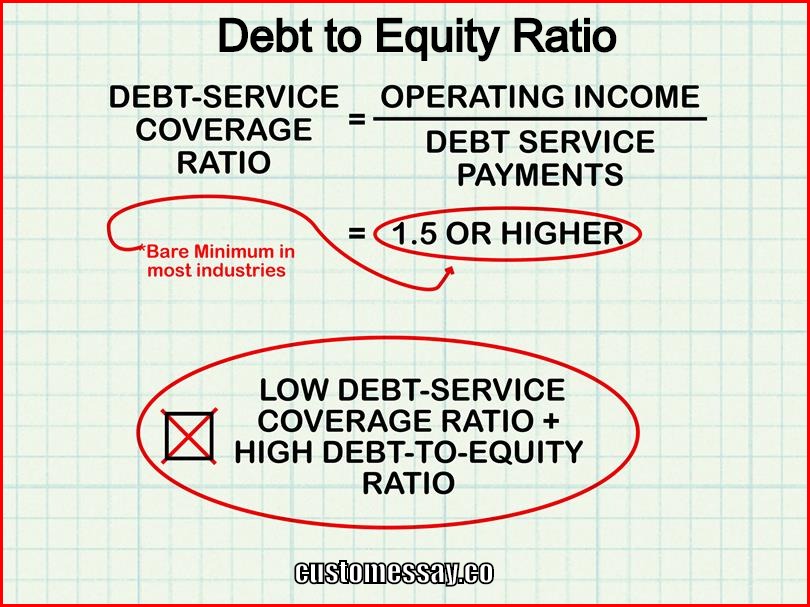

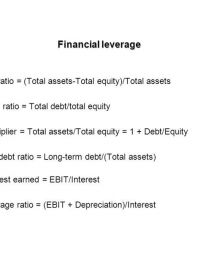

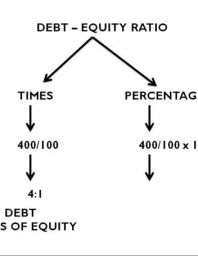

WHAT IS THE FORMULA OF DEBT TO EQUITY RATIO?

There are two formulas for its calculation, depending on the temporality of the debt:

DEBT TO EQUITY RATIO = Short-term non-current assets (current liabilities) / Equity (net)

DEBT TO EQUITY RATIO = Long-term non-current assets (fixed liabilities) / Equity (net)

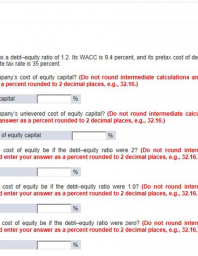

Typically, companies are interested in having the bulk of the financing of others in the long term, so that they can deal with debts in a longer period of time. The ratios of financial autonomy and indebtedness are closely related (the debt ratio is calculated inversely to that of financial autonomy). Therefore, the calculation of any one of them allows to evaluate the financial risk presented by a company with respect to its financial structure.

WHAT IS RATIO OF DEBT TO EQUITY IS USED FOR?

- Analysis of the possibility of using additional borrowed sources of financing, the efficiency of supply-side activities, the optimal decisions of financial managers in the choice of objects and sources of investment.

- Analysis of the structure of debt, namely: the share of short-term debts in it, as well as arrears in the payment of taxes, wages, and various deductions.

- Determination by the creditors of financial independence, stability of the financial position of the organization, which plans to attract additional loans.

HOW TO INTERPRET LT DEBT TO EQUITY RATIO?

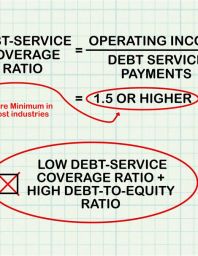

Usually, it is considered an equal ratio of liabilities and equity (net assets), i.e. The coefficient of financial leverage is 1. The value may be up to 2 (in large public companies this ratio may be even greater).

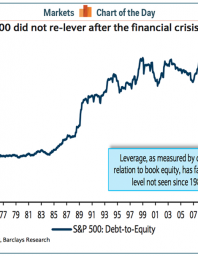

At large values of the coefficient, the organization loses its financial independence, and its financial position becomes extremely unstable. It is more difficult for such organizations to attract additional loans. The most common value of the coefficient in developed economies is 1.5 (60% of borrowed capital and 40% of own capital).

Too low value of the financial leverage ratio speaks about the missed opportunity to use the financial lever – to increase the return on equity by involving borrowed funds in the activity.

Like other similar factors characterizing the capital structure (the coefficient of autonomy, the coefficient of financial dependence), the normal value of the financial leverage coefficient depends on the industry, the scale of the enterprise and even the way of organizing production (capital-intensive or labor-intensive production). Therefore, it should be evaluated in dynamics and compared with the indicator of similar enterprises.

We hope you liked the article, and now are familiar with the definition debt to equity ratio well enough!